(www.MaritimeCyprus.com) The United Nations Conference on Trade and Development (UNCTAD) has published the Review of Maritime Transport 2019 study, presenting in it a fall in maritime trade growth. The report highlights trade policy crosscurrents, geopolitics and sanctions, environmental worries, fuel economics and tensions regarding the Strait of Hormuz, all of which have contributed to slower growth in merchandise trade.

World maritime trade lost its momentum in 2018 due to increased uncertainty, rising tariff tensions between the US and China, as well as concerns regarding other trade policy and political crosscurrents. These relate to a no-deal Brexit, which sent waves through global markets, according to UNCTAD’s Review of Maritime Transport 2019.

As a result the report shows volumes in the sector increased by only 2.7% last year, below the historical averages of 3% and 4.1% recorded in 2017.

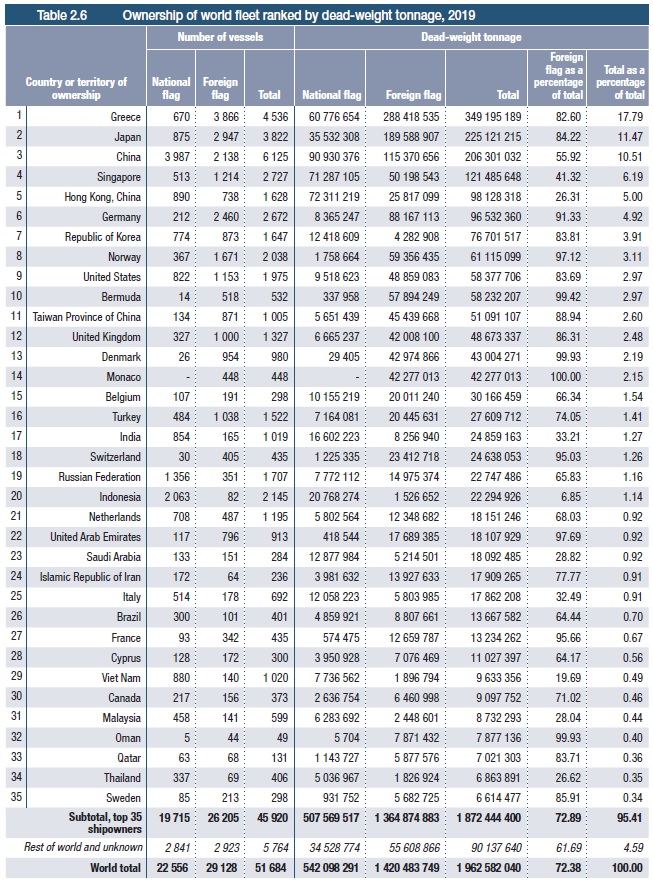

As of 1 January 2019, the top five shipowning economies were Greece, Japan, China, Singapore and Hong Kong China, accounting for more than 50 per cent of the world’s tonnage (table 2.6). Data for the last five years reveal that Germany, Japan and the Republic of Korea have been losing ground, while Greece, Singapore, China and Hong Kong, China have sustained an increasing trend.

In terms of the commercial value of the fleet, the top five shipowning countries in 2019, representing 45 per cent of the world total, are Greece, Japan, the United States, China and Norway. Greece is among the leading owners of oil tankers, bulk carriers and gas carriers; Japan and China, of bulk carriers; Germany, of container ships; and the United States, of ferries and passenger ships.

“The dip in maritime trade growth is a result of several trends including a weakening multilateral trading system and growing protectionism. It is a warning that national policies can have a negative impact on the maritime trade and development aspirations of all,” commented UNCTAD Secretary General, Mukhisa Kituyi.

Not only affected by a slowdown in the global economy during 2018, seaborne trade also faced other difficult headwinds such as geopolitical tensions, while preparing for an expected surge in ship fuel costs because of the IMO 2020 sulphur cap.

Taking these factors into consideration, UNCTAD expects international maritime trade to grow at an average annual growth rate of 3.4% over the 2019 – 2024 period, driven mainly by growth in containerized, dry bulk and gas cargoes. However, uncertainty is still a worrying theme in the current maritime transport environment, with risks tilted to the downside.

Isabelle Durant, Deputy Secretary General of UNCTAD, provided her comment on the report and how the industry will be affected, saying that the maritime sector is key for many reasons. Namely, in the challenges of today with climate change, digitalization and geopolitical tensions between the US and China, Ms Durant said that maritime has to adapt to change in order to reduce its emissions, respect the ocean, and also adapt to the new economic model that is being developed everywhere.

Moreover, regarding how shipping can better position itself to the changing global environment, she added that, “We don’t have to wait for new regulation coming from the public authorities. The fact that the industry on its own is working on international level to find a way to change and adapt to new rules and then maybe influence the decision of the consumers is important”

Indicating slower maritime trade, growth in global port traffic was also reduced, with container port traffic increasing by just 4.7% in 2018, from a 6.7% growth rate in 2017.

Additionally, container trade growth weakened. In fact, in 2018 volumes only increased by 2.6%, compared with 6% in 2017. This was matched with a sustained delivery of mega container ships, with container fleet supply capacity in 2018 increasing by 6% as compared to 4% in 2017. These developments further compressed freight rates in 2018. What is more, chemical tankers and bulk carriers have shown stable growth, unlike the oil tanker segment, which saw declining growth.

However, in spite of the setbacks, a milestone was reached, as the total seaborne trade volumes grew to 11 billion tons.

What is more, the maritime transport industry also saw the LNG sector increasing, because of intensifying pressure to promote cleaner energy sources. Bulk carriers, oil tankers and container ships recorded the highest level of ship deliveries, with LNG carriers recording the highest growth rate at 7.25%.

Nevertheless, the report warns that while global growth could swing in a positive direction, the balance of risks to the outlook remains poor.

Specifically, the risks are high for the most vulnerable economies, with the report highlighting a growing connectivity divide between the most and least-connected countries. As a matter of fact, various small island developing states are among the countries with the lowest shipping connectivity, as they face a vicious cycle where low trade volumes discourage investments in better maritime transport connectivity, and faced with low connectivity, merchandize trade becomes costly and uncompetitive.

Ports can also benefit from shipping connectivity, from leveraging digitalization and next generation technologies for efficiency and productivity gains.

In the meantime, key structural trends that started over a decade ago, are beginning to transform the maritime transport landscape. The industry is currently transitioning away from patterns observed before the global financial and economic downturn hit the world economy.

Commenting on this, Shamika N. Sirimanne, director of UNCTAD’s division on technology and logistics, stated that, “Today, the maritime sector is dealing with much more than market uncertainty and short-term cyclical factors. Other factors that are structural and existential, such as technological disruptions and climate change are at play and are redefining the sector.”

Ahead of slower global economic and trade growth compared with the pre-2009 era of bullish growth rates, global maritime transport is increasingly now shaped by new demand and trade patterns, growing regionalization of supply chains and rebalancing in China’s economy, along with a larger role of technology and services in value chains and logistics.

It is also facing intensified and more frequent natural disasters and climate-related disruptions, thus making climate-risk assessment, adaptation and resilience building for seaports and other coastal transport infrastructure an increasingly urgent priority.

To address these new risks, the industry has adopted an accelerated environmental sustainability agenda, with an increased awareness of the impact of global warming, and the necessity of fast-tracking the energy transition towards cleaner fuel sources. The IMO 2020 Sulphur Cap regulation is a prime example.

The effects of this change are already being felt, as some services, like those in container shipping and shipbuilding, are merging, while others are expanding their scope to contain landside and logistic operations.

Furthermore, some are calling for more governmental support for shipbuilding activities or financing for the technology needed to develop zero-emission vessels.

Nevertheless, while adapting to the new normal may include some possible challenges, the report highlights that it could also open some opportunities. Supporting this process calls for enhanced planning, adequate response measures, as well as flexible and forward-looking transport policies that anticipate change.

Click below to download full UNCTAD report:

Source: United Nations Conference on Trade and Development (UNCTAD)