(www.MaritimeCyprus.com) On January 1, 2020, the most recent edition of Incoterms® came into effect. Among the changes are a new set of rules, DPU (described below), new carriage security obligations, cost clarifications, and changes to insurance requirements and buyer and seller obligations. Parties using Incoterms® in their contracts should be aware of, and where possible take the benefit of, these changes. Unless the applicable Incoterms® rules are otherwise specified, contracts entered into effective from January 1, 2020 that refer to Incoterms® rules, will likely be assumed to be using the 2020 rules.

What are Incoterms?

International Commercial Terms ("Incoterms®") are rules that specify terms of trade designed to help traders avoid confusion by clarifying the tasks, costs and risks involved in the sale of goods from sellers to buyers. The International Chamber of Commerce (ICC) first published the Incoterms® in 1936, and since then has issued new rules periodically to conform to changing trade practices.

Traders and their service providers should understand how the latest edition of Incoterms® is different than the previous editions. While traders are encouraged to use the most current version of the rules, they can choose to use Incoterms® 2010 or earlier editions provided that the non-current edition is clearly specified as applicable in the contract. For contracts effective on or after January 1, 2020 that refer to any three-letter Incoterms® rule without further specification as to edition, it is likely that Incoterms® 2020 will apply. Canadian courts and tribunals have relied on the Incoterms® rules used by the parties to determine key questions concerning the delivery of goods and contractual conditions.

Key Changes in Incoterms® 2020

- A "New" Incoterm: "DAT" becomes "DPU" Under previous editions of the Incoterms®, the DAT rule ("Delivered at Terminal") determined that goods were delivered once unloaded at the specified terminal, although the accompanying guidance note clarified that a "terminal" could be any place. Following feedback that the reference to a "terminal" was too specific, Incoterms® 2020 renames DAT to DPU ("Delivered at Place Unloaded") and clarifies that any place (e.gs., factory, warehouse, other facility) may be the place of destination. DPU is the only Incoterms® rule that requires the seller to unload goods at destination. If the parties do not intend the seller to bear the risk and cost of unloading, they should rely on the term DAP ("Delivered at Place").

- New Security Obligations Incoterms® 2020 adds transport-related security requirements to many of the Incoterms® rules. Sellers must now comply with security-related carriage requirements found at section A4 of the relevant Incoterms® rule, and section A7 requires the seller to carry out security-related export clearance procedures or to assist the buyer in obtaining any documents needed to comply with such procedures.

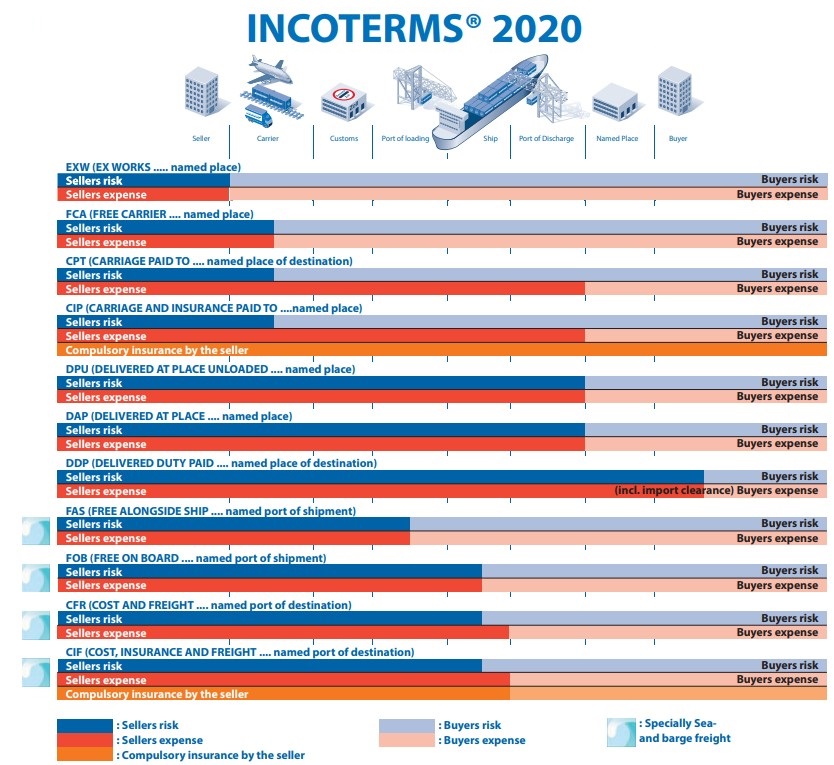

- Cost Clarifications In previous editions, allocation of responsibility for costs appeared in different parts of each rule's description. Incoterms® 2020 presents a "one-stop list of costs" so that sellers and buyers can readily identify which party, buyer or seller, is responsible for which costs associated with the movement of goods. Generally, the seller is responsible for costs (and risk) up to the point of delivery, and the buyer is responsible for costs (and risk) beyond that point, which is why it is very important for parties to specify the port, place or point as required by the rule selected. Where the risk of transport is transferred at origin (i.e., country of the seller), any liability while the goods are in transit is assumed by the buyer, and when the risk is passed at destination (i.e., country of the buyer), the seller bears the liability in transit. Each term now includes helpful graphics and explanatory notes that indicate exactly when cost and risk are handed off from seller to buyer.

- Changes to Insurance Cover Required for "CIF" and "CIP" Parties using CIF ("Carriage Insurance and Freight") and CIP ("Carriage and Insurance Paid") should be aware that Incoterms® 2020 introduces different minimum levels of insurance coverage. Under the Incoterms® 2010, both CIP and CIF required the seller to purchase certain minimum basic insurance (Institute Cargo Clause "C" insurance) for the benefit of the buyer. Buyers were not often aware of the limitations of Clause C coverage, which does not cover damage in transit. Incoterms® 2020 increases the insurance required for CIP to Institute Cargo Clause "A" insurance, which is more comprehensive (and more expensive). This change reflects the fact that CIP is often used for complex, manufactured, and multi-modal goods that have a higher value and are more easily damaged than commodity goods that commonly use CIF. Buyers should be aware of the distinction between these terms to ensure that their shipments have appropriate insurance coverage.

- The Obligations of Sellers and Buyers Are Reorganized As in previous editions, Incoterms® 2020 lists the obligations of the seller and buyer in separate sections, with A1 – A10 representing the Seller's obligations and B1 – B10 representing those of the Buyer. The obligations have been reordered from past editions, so that more vital obligations are listed at the beginning of the list.

- FCA and Bills of Lading Incoterms® 2020 revises the terms applicable to the "FCA" rule to allow parties to agree that the buyer will direct the international carrier to issue an onboard bill of lading to the seller with the annotation of "aboard", which specifies that the goods have been loaded. Previously, the seller was responsible for loading goods onto the transportation hired by the buyer, which is not necessarily the international carrier vessel/vehicle. This may have caused delay in the seller getting paid, since banks may require that an "on board" bill of lading be presented before payment against a letter of credit. Through this mechanism, sellers can now obtain a bill of lading with an on-board notation from the carrier once the goods are on board where one might not otherwise be issued. The explanatory notes for this term in Incoterms® 2020 clarify that if the parties agree that the seller will present a buyer a bill of lading that simply states the goods have been received for shipment, this new option is unnecessary, and there is no obligation that the seller issue these terms to the buyer.

- Seller or Buyer Self Transporting Goods Past editions of the Incoterms® were based on the assumption that the transportation of goods by the seller to the buyer would always be carried out by a third-party carrier. Certain rules in Incoterms® 2020 now specify that a buyer or seller may carry out the transportation on its own.

Other Considerations

Incoterms® are not "be all and end all"

While the Incoterms® are helpful in defining the obligations of sellers and buyers for carriage and insurance, the costs associated with the transportation and customs clearance of goods, and the point at which risk of loss or damage transfers from seller to buyer, it is important to remember that Incoterms® rules do not cover the following contract terms:

- The transfer of title over goods;

- Terms of payment;

- Legal recourse for breach of performance;

- The governing jurisdiction; and

- Dispute resolution options.

Incoterms® and potential tax implications

Importers and exporters should also be aware that tax implications may arise from usage of Incoterms® rules in their contracts. For example, if the contract does not otherwise specify the place of "delivery", this will be determined under local sale of goods legislation, which could impact whether GST/HST (value added taxes) must be collected and remitted in connection with the sale. Without reference to Incoterms®, a buyer or seller may have to produce substantial amounts of evidence to prove their intention to designate a place of delivery to avoid taxes on a transaction.