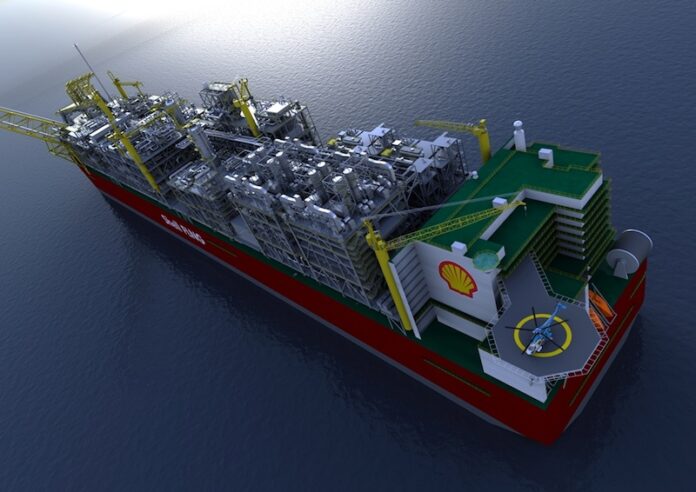

(www.MaritimeCyprus.com) Prelude or finale? That’s a question some observers are starting to ask about a $12 billion ship called Prelude which was supposed to revolutionize the liquefied natural gas (LNG) industry.

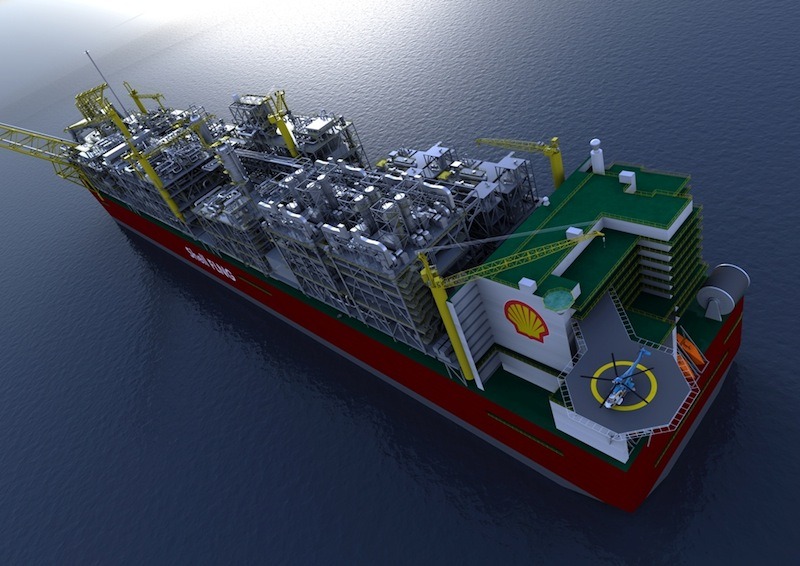

Built by Royal Dutch Shell, Prelude is designed to move from one offshore gasfield to another, avoiding the need for costly offshore structures and pipelines to shore-based gas processing facilities.

News from Shell about Prelude, a 600,000 tonne vessel moored 300 miles off Australia’s north-west coast, has been skimpy since construction costs rose sharply, installation was delayed for years, and repeated attempts to start production were frustrated by equipment problems.

Bold Experiment, Poor Outcome So Far

The net result is that a bold experiment which started by building a barge five-times larger than the biggest U.S. aircraft carrier, has become an embarrassment for Shell and a dampener on the theory of floating LNG production.

Financially, Prelude is also proving to be a heavy burden with Shell forced to write-off much of the construction costs while never admitting that the experiment has failed.

But, a hint of failure is reported to be contained in the latest annual report of Shell Australia obtained by The Australian newspaper but not widely distributed.

The key word in the Shell Australia report, according to the newspaper, is "attractiveness" a description applied to Prelude in Shell’s discussion of asset value write-downs which dominate a $4.9 billion loss for 2020 by Shell Australia.

Like all oil companies, Shell took a hit last year when the oil price collapsed, with some futures contracts briefly diving into negative territory while the commonly traded price of Brent-quality crude dipped as low as $19 a barrel.

Oil has been moving higher since that price crash but whether it will rise to a point where Prelude can achieve a “commercial break-even” level is a question which has landed on the desk of Royal Dutch Shell’s incoming chairman, Andrew Mackenzie.

It will be the former chief executive of BHP who takes up his new post at Shell next month who will be forced to make a decision on whether to persevere with the Prelude experiment on write it off as a failure.

Work In Progress

The official position before a fresh Prelude write-off played a key part in Shell Australia’s latest loss is that Prelude is a work in progress with problems rectified as they occur.

But, with the giant barge already having cost Shell somewhere between $12 billion and $17 billion (the exact figure has not been revealed) it might be viewed as courageous by Shell shareholders if Mackenzie continues with the floating LNG trial.

Not only has a large amount of capital been invested in Prelude with no return, yet, but the outlook for oil and gas in a world veering towards renewable energy is an added complication.

Rather than Shell persisting with Prelude a case appears to be emerging for a finale.

Source: Forbes