(www.MaritimeCyprus.com) Shipping is integral to global trade, transporting ~80% of goods by volume (UNCTAD, 2021). Energy products were ~36% of global seaborne trade in 2021, with around 15% of coal, 17% of natural gas and 64% of oil produced globally moved by ship (Clarksons, 2022a). Interactions between the energy system and the shipping industry are a key determinant of the success of new supply chains for an energy transition compatible with limiting global warming to 1.5˚C.

This report, commissioned by the International Chamber of Shipping and written by researchers at the Tyndall Centre for Climate Change Research at the University of Manchester, provides insights on the implications for the shipping sector of different global energy scenarios for pursuing efforts to limit global temperature rise to 1.5˚C, and the opportunities for shipping to support the global low-carbon transition.

Scale of the global energy transition

It is imperative that nations keep global heating below 1.5˚C – in line with the Paris Climate Agreement. Even at 1˚C of warming, climate impacts on humanity and nature are already extensive and growing. The risk of passing multiple climate tipping points increases rapidly between 1.5˚ and 2˚C.

To meet the Paris goals, major and unprecedented levels of carbon dioxide emissions reductions are needed this decade, on a pathway to zero emissions around 2050. The timescales are extremely urgent. Delay is not an option.

Meeting this challenge has profound implications for global energy use, and the systems that provide that energy. A suite of energy scenarios that limit temperature rises to 1.5˚C are assessed in this report. Five changes to the energy system by 2050 are consistent across these scenarios:

- Reductions in overall global energy consumption, mainly due to greater energy efficiency;

- Rapid electrification of many sectors of the global economy;

- Rapid decarbonisation of the electricity sector, with large increases in wind and solar replacing coal and gas;

- Rapid reductions in coal, oil and gas use;

- Growth in the use of lower-carbon fuels such as hydrogen and bioenergy.

However, delivery of these changes is currently way off-track. Far more assertive Government action is urgently required.

Implications for the shipping sector of meeting the Paris goals

If realised, these energy system changes will have profound implications for shipping, as 36% of the shipping sector’s current trade is transporting energy products, primarily oil, coal and gas. In future, shipping will transport different fuels, in different quantities, between different countries, and if the 1.5˚C scenarios become a reality, this transition will start in earnest in a timeframe as short as months and years. This presents challenges and opportunities.

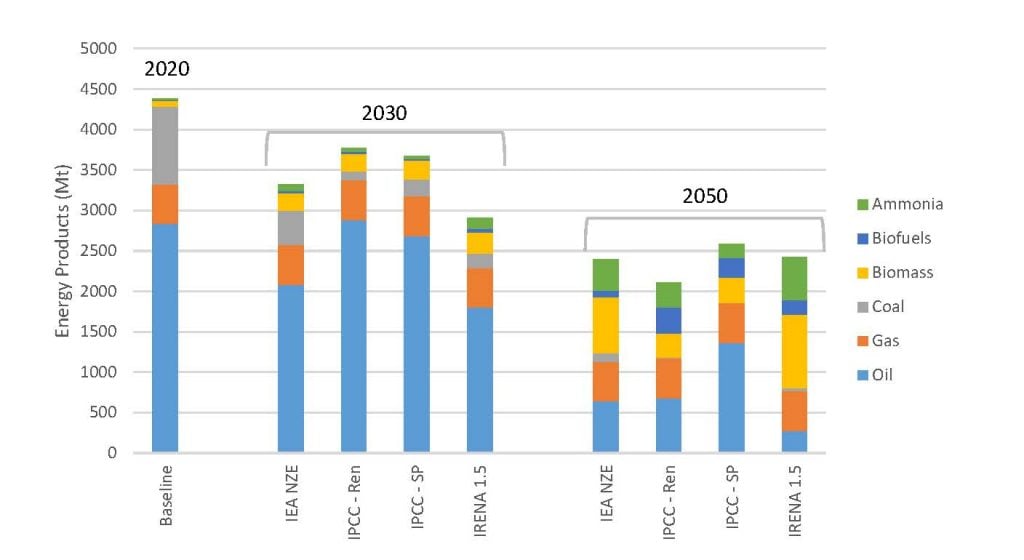

Overall, the mix of energy products transport by ship changes, while total shipping of energy products falls: growth of transport of new fuels is outweighed by greater falls in shipments of oil and coal. Figure A shows potential shipments of fuels in the 1.5˚C scenarios reviewed here, compared with today.

The scenarios show that a 1.5˚C transition reduces the global quantities of coal, oil and gas produced, transported and consumed, and increases the quantities of hydrogen and biomass, with hydrogen transported by ship in the form of ammonia.

To realise these scenarios, the shipping sector needs to prepare for a rapid transition away from transporting coal and oil for energy consumption. Reductions start this decade. By 2050 coal shipments fall 90-100%, oil 50-90%. Although natural gas consumption decreases too, a greater proportion of this gas is transported by ship, so the shipping sector would expect a continuing role for shipping natural gas products in the medium-term.

An opportunity is that future bioenergy and ammonia shipments have the potential to be as high as coal and gas shipments today. These increased shipments will not be technically difficult for the sector to deliver, given existing infrastructure and familiarity with cargoes. Nevertheless, such increases still do not offset an overall decline in energy products transported by sea.

Gap between plans and real progress on delivering 1.5˚C

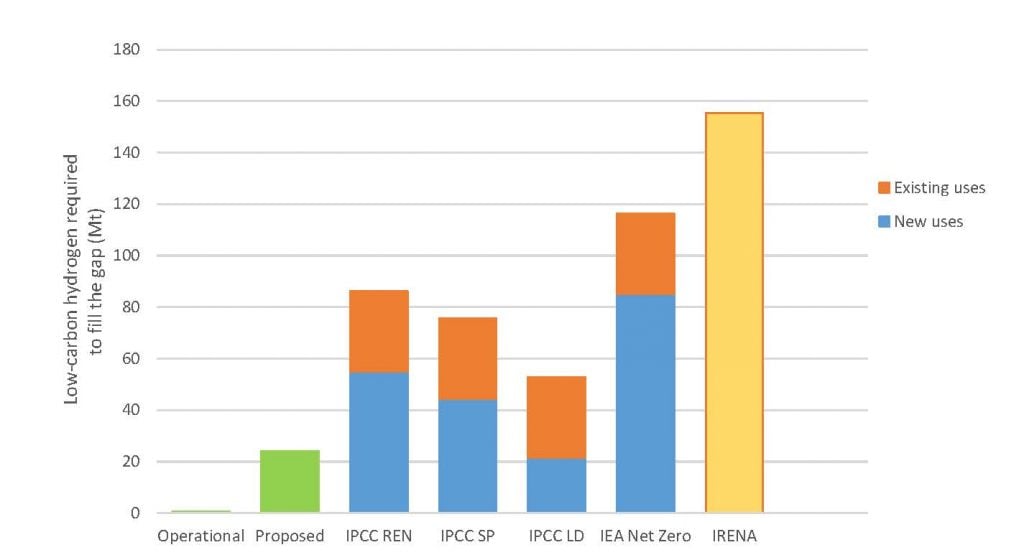

Hydrogen-based fuels present a major opportunity for the shipping sector. However, there is a big gap between the planned production of low-carbon hydrogen, and what is required to deliver these 1.5˚C scenarios. The International Energy Agency estimates low-carbon hydrogen production of 24 Mt by 2030 but 1.5˚C scenarios need at least double that figure. Moreover, the majority of the projects comprising this 24 Mt are still at concept or feasibility stage. Although project announcements are growing very rapidly, projects with final investments decisions are scarce; with project developers unsure of potential markets, and potential consumers unsure of suppliers. Stronger policies are needed now to translate the recent surge of interest in hydrogen into actual projects, and to connect consumers and producers.

There are two sources of demand for low-carbon hydrogen. First, replacing the highly carbon-intensive current method of “grey” hydrogen production. Second, 1.5˚C scenarios assume a growing need for hydrogen in new uses – for example in industry, shipping, aviation and power generation. This must also be low carbon. Current grey hydrogen tends to be produced very close to where it is used, with low transport needs. However, given that for green hydrogen in particular, producer countries are likely to be distant from consumer markets, transport of green hydrogen will be necessary, either by pipeline or ship. As distances increase, shipping will be preferable.

It is economically more efficient to ship hydrogen as ammonia. There is however a cost penalty at the destination in converting ammonia back to hydrogen. Therefore, the best export markets for green hydrogen producers are likely to be those with direct uses of ammonia, such as in fertiliser manufacture – avoiding the need for reconversion. Five insights that arise from increasing production and shipping of green ammonia are:

- Existing fertiliser manufacture is the largest potential market for low-carbon hydrogen to 2030, while new energy uses scale up.

- It is imperative that existing hydrogen production is decarbonised quickly, as part of the wider global energy transition; grey hydrogen production is highly carbon-intensive, with CO2 emissions equivalent to the entire shipping sector.

- Imported green ammonia can reduce reliance on natural gas, increasingly important for many countries’ strategic goals around energy security.

- Green ammonia is becoming economically viable – the recent price hikes for natural gas, and falls in electrolyser, wind and solar costs, mean that in the EU, imported green ammonia can be cheaper than domestic grey ammonia production, around a decade earlier than thought likely just two years ago.

- The shipping sector will need to increase the number of ammonia-carriers, accelerating to construction of around 20 large vessels a year in the latter half of the decade. This represents a scale-up of the recent rate of five vessels a year.

Bioenergy use grows in the 1.5˚C scenarios, but needs to be subject to strict requirements on sustainability impacts. It is likely there will be growth in shipments of both biomass and biofuels, although there is great uncertainty about sustainable levels of bioenergy production, and the countries that would see greatest growth.

For bioenergy too there is a gap between planned projects and required ambition. The growth rate for biofuels has been 5% a year in the last decade, however the growth rate in sustainable biofuels needs to increase to between 7% and 18% per year to deliver these 1.5˚C scenarios by 2030.

Production scale-up appears stalled by a lack of confidence in sustainable markets for low-carbon hydrogen and second-generation bioenergy products. Action from governments and investors is needed if these fuels are to reach the levels required.

Priorities for policy makers

There is a coordination issue potentially holding development of hydrogen in limbo, with hydrogen projects requiring buyers before final investment decisions are made, and sectors planning a move into hydrogen being unsure of supply. These are compounded by major further infrastructure investments often being needed to deliver hydrogen products from producers to consumers. The priority is therefore to convert the current explosion of interest in hydrogen into actual projects in the coming few years.

National hydrogen strategies for consumer countries need to have a greater focus on imports if the gap between what’s needed in the 1.5˚C scenarios and what is materialising in practice is to close in time. The EU’s recent RepowerEU target to import 10Mt green H2 by 2030 is a positive example, but needs to be backed up with enabling policies. Four examples are:

- The German H2Global contract-for-difference double-auction proposal is a positive development, providing guaranteed markets and prices for producers and consumers.

- Bilateral contracts between countries could be deployed to a greater extent – mirroring the accelerated growth of the Australian LNG sector in the 2010s after long-term high-volume contracts were signed with China.

- Mandates for increasing percentages of green hydrogen should be introduced, as is being explored by India for its fertiliser and refinery sectors.

- Stronger policy is also necessary in more producer countries – the recent $3/kg H2 production credit in the Inflation Reduction Act is a positive example which could deliver exponential growth in the USA’s green hydrogen production.

The short-medium term gap between likely production and 1.5˚C requirements makes it even more imperative that countries treat low-carbon hydrogen as a valuable resource that is deployed carefully and not used in sectors with cheaper and more efficient alternatives, for example in surface transport and domestic heating. Hydrogen strategies should prioritise decarbonising existing hydrogen consumption, and sectors where there are fewer alternatives – such as shipping.

Because of shipping’s international nature, there is a danger that shipping will slip through the net of national strategies, both in terms of investment in infrastructure for importing or exporting hydrogen, and for the shipping sector’s own future use of hydrogen. The different pace of growth of new hydrogen demand across sectors has two main implications for shipping.

First, in the short term it is unlikely that the shipping sector provides the much needed demand-side impetus for green hydrogen projects. That role will fall to decarbonising existing hydrogen processes. If this occurs, there will be a major role for the shipping sector as an enabler of the wider energy transition, in connecting producers and consumers. There is extensive infrastructure already in place globally for ammonia shipments, and experience in using it. Annual build rates for new ammonia carriers to meet a rising demand for ammonia in 1.5˚C scenarios are high – at around 20 large carriers per year – but this is within the range of what has been achieved in previous years.

Second, because the sector has a slow turn-over of assets, it will only be in the 2030s and 2040s that the shipping sector becomes a major user of hydrogen products, including ammonia, to decarbonise its own operations. But steps need to be taken now to ensure infrastructure is developed in time for the rapid scale-up in the 2030s. New ammonia carriers need to be designed to run on ammonia to gain synergies in development and deployment of bunkering infrastructure. Overall, at least 5% of the fuel used by the shipping sector needs be low-carbon by 2030, as a platform for more rapid deployment in the 2030s. In addition, deployment of green hydrogen hubs and corridor initiatives, as well as other measures to connect producers and suppliers will be required. The work of the ICS’ Clean Energy Marine Hubs, the Getting to Zero Coalition’s green corridors work, and bunkering initiatives in Singapore and Rotterdam, among others, are recent examples of what will be needed.

Crucially, the success of low-carbon hydrogen and sustainable biofuels is critically dependent upon robust and enforced mechanisms to ensure full-lifecycle emissions and other sustainability impacts are fully accounted for, and that genuine sustainability and greenhouse gas (GHG) benefits are realised. This means ensuring bioenergy production does not cause deforestation or conflict with essential uses of land for food, and that for both bioenergy and hydrogen, upstream as well as downstream GHG emissions are measured. Clear accounting methodologies need to be strengthened, integrated and consistent across the whole energy sector.

The shipping sector will be pivotal in facilitating the global energy transition needed to protect humanity and nature from the worsening impacts of climate change. Although it can expect to transport far lower quantities of energy products in a 1.5˚C future, the sector has a crucial role in enabling trade in new low-carbon energy products.

For more details, download the report "Shipping’s Role in the Global Energy Transition":

Source: ICS