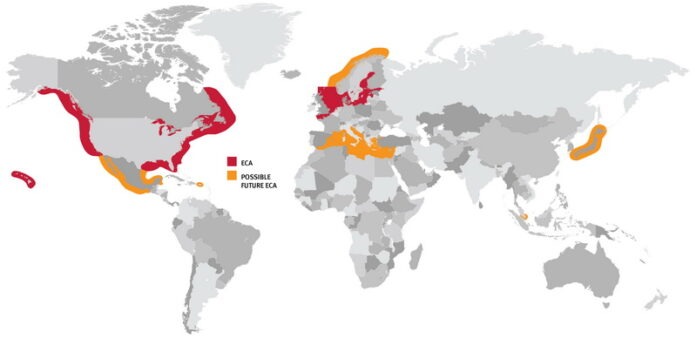

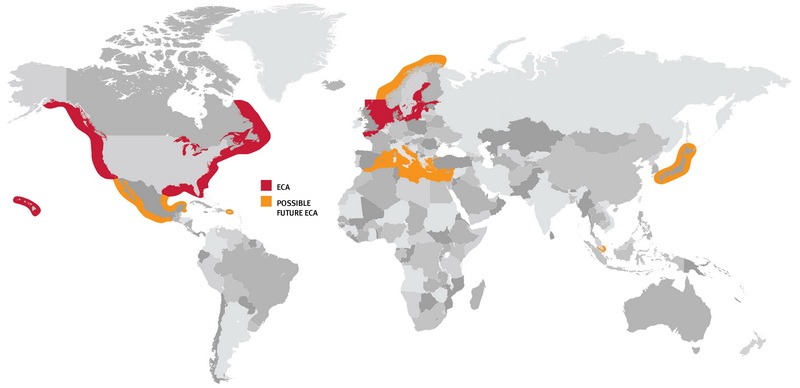

As of the 1st January 2015 the sulphur limit in Emission Control Areas (ECAs) will take a highly significant drop from 1% to 0.1%. It may only look like a small number but this shift will have a high impact. The following are Fathom cTech’s top 10 reasons why ship operators should be nervous about the sulphur challenge that the maritime industry is facing and what can be done to remain competitive.

As of the 1st January 2015 the sulphur limit in Emission Control Areas (ECAs) will take a highly significant drop from 1% to 0.1%. It may only look like a small number but this shift will have a high impact. The following are Fathom cTech’s top 10 reasons why ship operators should be nervous about the sulphur challenge that the maritime industry is facing and what can be done to remain competitive.

- The Rising Costs of Bunker Fuel

* There is a significant price differential between Heavy Fuel Oil (HFO) and Marine Gas Oil (MGO). For example, in the previous three years the current price differential is at $260 per tonne in Rotterdam and $330 per tonne in Houston according to Bunkerworld, whilst in the previous two years Rotterdam has seen as much as $337 differential.

* MGO prices are expected to rise as much as 20% in 2015 due to the increased pressure expected on their supply.

* Maersk Line estimates that the MGO is likely to be around $900 dollars per tonne once the regulations are introduced – 50% more than what carriers pay today for regular fuel.

The volume of low sulphur fuel from 2015 onwards is expected to create additional costs of around $150 million dollars per year for them.

- The Rising Cost of Transportation

* The cost of transportation is likely to continue to increase. Carriers will have to meet additional costs to meet the tighter pollution controls. However, large shippers may take more convincing to pay a separate low sulphur surcharge, according to Drewy Maritime Research.

* Carriers will also need to provide calculations to justify these increases.

* Avoiding ECAs to reduce fuel surcharges may result in increased transportation time.

* Increases in freight rates, particularly for short sea services,could lead to modal shift.

- The Practicality of Retrofitting Vessels Scrubbers

* Large scrubbers can be costly and take up vital space on board a vessel which in turn can reduce cargo carrying capacity.

* Ship scrubbers are still a relatively ‘new’ technology to the industry. Providers may not necessarily have a well proven history of the reliability of the systems machinery and its application onboard a vessel.

* The time taken to undertake a retrofit to a vessel reduces the time that vessel is in operation, increasing standby and impacting costing.

* If the uptake of scrubbers dramatically increases, the suppliers may not be able to scale up production in order to meet the demand.

* Newbuilds may be easier and/or cheaper to run with the technology than retrofitting current vessels. If companies choose to wait and start retrofitting their newbuilds instead of current ones, their establishment of a fully functioning newbuild fleet that will meet the 2015 standards, will take considerable time to establish.

* Awareness of overboard discharge is crucial, particularly as IMO guidelines and inspections are to become more stringent in line with the new regulations. LNG

* It is expensive and difficult to retrofit a vessel to enable it to use LNG as fuel.

* LNG retrofits are very large and often are viewed as not being cost effective. They take up a lot of space and reduce the amount of vessel available to carrying cargo.

* LNG retrofits can be a lengthy process and significantly reduce the amount of time a ship is operating in waters.

- Mechanical Problems Arising From Fuel Switching

The variation in sulphur content has a significant impact on the fuel properties. Unless systems are carefully maintained and prepared, significant issues may arise when utlising the same systems with the different fuels.

* Distillates do not require heating like HFO. If the temperature of distillates is too high, the viscosity will be greatly reduced below the point at which systems function correctly.

* Pump failure can occur from increased wear due to a lower hydrodynamic lubricating fuel oil cover exists, driven by the low viscosity.

* Distillate fuels can ‘gas up’ at too high temperatures leasing to vapour locking and fuel starvations.

* There can be difficulties during start and low load operations due to leaking pumps from low fuel viscosity

* Blocked fuel filters can result from incompatible fuels mixing leading to precipitation of heavy sludge and potential filter clogging. Improper engine function and shutdown are the result. * Pump malfunction can occur where the changeover takes place too quickly. If this leads to total pump seizure, engine shutdown may result.

* Fuels of unduly low viscosity will flow through fine clearances previously ‘sealed’ by fuel at higher viscosity resulting in fuel leakage and reduced power.

These are just some of the issues that can arise with further being seen through the cleaning/searching action of distillates, the lubricity issues and more. However, all of these issues can be avoided by careful preparation of the vessels.

- Fuel Availability

The availability of fuel is of rising concern for ship owners. As demand for lower sulphur fuel rises to meet regulations, the pressure on suppliers may outweigh the ability for them to deliver. Some of the issues to be considered are:

* Low sulphur fuel may not be readily available in ports due to the increased demand. It may only be able to be supplied if specifically requested. Ship owners should not assume a low sulphur fuel can be guaranteed for them on arrival at port.

* Refineries have to reflect the availability of bunker fuel because they prioritise higher-level distillates. * Managing price differences in fuel availability while in long-term contracts can be challenging for ship owners. A separate bunker fuel surcharge is created with changes along with fuel prices to offset the destabilising effects. Because of the volatility bunker fuel availability and cost is a huge concern for ship owners.

* Cruise ships in particular need to be aware regarding fuel availability and their choice of sailing destination. Lack of fuel availability in specific ports may result in changes to their itinerary which may also increase the cost of cruising to passengers.

* It can also not be guaranteed that the fuels will be close to the 0.1% limit. For example it maybe that distillates of automotive grade could be supplied if supplies are short which can be as low as 0.001% sulphur and have very different characteristics. Ship owners need to consider the characteristics of these fuels if they use them within their vessels.

- Loss of Vessel Power

* Switching and changing of the lubricant supply to the main engine at the same time is complex and can result in ship’s loss of power and in the worst case scenario an engine room fire.

* Loss of power and the risk of accident needs to be considered in the event of a collision. Poor switchover has been reported to be a major cause of engine damage and fire.

* Lack of training and ability for crew to be able to safely operate the fuel switchover process enhances risk.

* In California, as of July 2014, 93 loss of propulsion incidents occurred of which 15 were directily related to fuel switiching to meet the state’s regulations on sulphur limits in fuel. This equates to 0.17% of all vessel movements.

* Based on the California statistics, there is likely to be an average of a loss of power incidence in the English Channel every three days. There are around 60,000 vessels which move in and out of the entrance of the English Channel, the North Sea and English Channel ECA border annually, a loss of propulsion incident occurring from fuel switching to just 0.17% of these vessels could translate to 102 incidents per year. Operators should ensure that not only are their systems suitably upgraded and maintained, but crew training to enhance the fuel changeover process and to minimise the risk of engine cut out is crucial. Experience in California has proved that crew training has minimised the risks and number of incidents.

- Competitive Disadvantage

* Some operators choosing not to comply because of the low fines will have an unfair advantage over those who do comply. Poor enforcement will increase this competitive advantage. According to Alan Murphy, SeaIntel partner: “Our analysis shows that a 4,500 teu vessel sailing at 16 knots from the beginning of the English Channel to Hamburg will save EUR 12,000 ($16,600) if it uses bunker fuel with a 1% sulphur content, instead of the mandated 0.1% sulphur content.” If some carriers choose to take on this risk and prefer to be fined rather than expend more on compliance options, the other companies will be at a much higher disadvantage.

* Those who have committed to remaining within the permitted emission limits could effectively be punished. “Nobody wants to see a situation where those that have made the biggest commitment to the new regulation suffer the most damaging financial consequences” according to European Community Shipowners’ Association (ECSA) head Patrick Verhoeven.

* Those companies with plans for newbuilds will find it easier to comply than those who own older fleets where implementing compliance options can be more challenging. Technologies or fuel switching may prove more expensive on older vessels than newbuilds, putting newer companies with younger vessels at an immediate advantage.

* Individual member states may provide incentives such as subsidiaries or lower port charges if ships choose to comply with sulphur regulations earlier than the mandatory date.

- Changes to Bunker Delivery Notes

* Ship owners and operators must be aware that changes to the Bunker Delivery Note may be in force. Where technology is used to comply with regulations, as supposed to a low sulphur fuel, new text must be added to the delivery note.

- Lubricant: Switching plus Supply & Demand

Lubricant suppliers may also face challenges in supplying ship owners with the required lubricant quantity to meet demand.

* Increasing pressure on marine lubricant providers will occur due to new fuels requiring new engine lubricants.

* lubricant switching is now needed much sooner with the new sulphur content of fuel. According to Iain White from ExxonMobil Marine Fuels and Lubricants ‘If the time in the ECA can be measured in hours rather than days, it may be possible to avoid changing oil, but for longer periods the oil must be switched.

- Vessel Adaptation Costs

* Whatever the compliance method, increased costs for vessel adaptation will apply notwithstanding the price of fuel utilised.

* If ship owners wish to continue to use HFO they will need to install scrubber abatement technologies to comply with permitted sulphur release content. Capital expenditure can run in to the millions

* Changing fuel due to rising prices also drive engine modifications due to the variations in viscosity and increase costs of compliance.

* The separation of different fuels require separate storage tanks, exacerbating cost and creating logistical difficulties.

* The requirement for separation tanks for different fuels increases not only the technology itself but the installation, maintenance and logistical difficulties will significantly increase capital output. However, using a low sulphur fuel may provide cost efficient in the long run due to the fact that a lower sulphur fuel is kinder to the vessel engine and may help to mitigate the impacts of a higher cost fuel.

Source: ECA