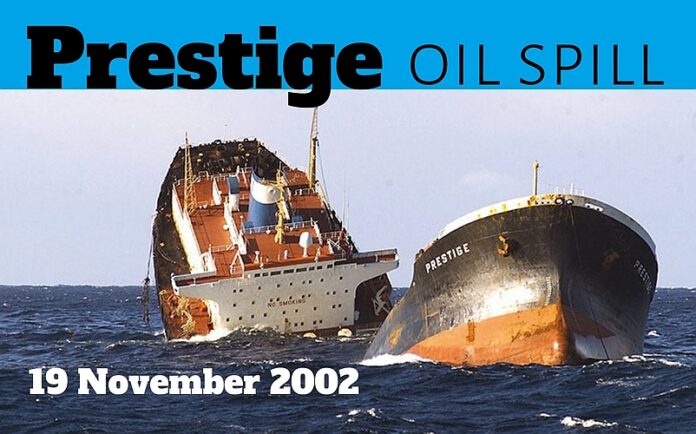

(www.MaritimeCyprus.com) On 19 November 2002, the single-hull Aframax tanker PRESTIGE broke in two and sank in waters of the North Atlantic off the northwest coast of Spain.

It had been carrying a cargo of 77,000 metric tons of heavy fuel oil from Russia and Latvia to Singapore when it encountered heavy weather on 13 November. It suffered structural failures and developed a substantial list.

A distress call was made to Spanish authorities.

The Spanish government exacerbated the situation by refusing access to a port of refuge. They then had the audacity to imprison the master, chief officer and chief engineer to deflect attention from the incompetence of the Spanish maritime authorities. However, the initiating cause was the the negligence of Class ABS that failed to properly identify and ensure adequate rectification of the heavy corrosion in the vessel’s uncoated segregated ballast tanks. This resulted in shell plating literally falling off No 2A and No 3 stbd tanks followed by flooding, heavy listing up to 25 degrees, water entry into the cargo tanks, extreme hull stress and the vessel ultimately breaking up and sinking. Class ABS and the Bahamas flag state emerged unscathed, despite their evident failure to ensure proper compliance with the SOLAS enhanced survey process.

Timeline:

The crew was evacuated shortly before the ship broke up. Much of the oil onboard was spilled immediately, and much of that came ashore on the beaches of Spain and Portugal and, to a lesser extent, France. Oil that remained onboard the wreck slowly seeped out and also came ashore.

Remotely operated vehicles (ROVs) were used to remove much of the remaining oil. In the aftermath, the European Union tightened its marine environmental protection regulations and pressed the International Maritime Organization (IMO) to take action. The phase-out dates for single-hull oil tankers were accelerated and restrictions were placed on the carriage of heavy fuel oil as cargo in single-hull tankers.

In a major miscarriage of justice, the master of the Prestige was arrested and held in Spain for an inordinate period on charges of impeding the movement of the tanker during the crisis. The Kingdom of Spain brought suit against the American Bureau of Shipping (ABS) for negligent classification of the tanker. The suit was eventually dismissed for lack of evidence. The criminal trial in Spain of the master and various others eventually ended with the master convicted of disobeying an order issued by the Spanish government. The captain, Apostolos Mangouras, was convicted of recklessness resulting in catastrophic environmental damage, according to a statement by the court, overturning a previous sentence which cleared him of criminal responsibility.

Captain Mangouras submitted a motion for dismissal of the Supreme Court judgment which found him to have been criminally liable for damage to the environment. The Supreme Court rejected that motion.

The PRESTIGE case also raises concerns regarding the effectiveness of the international liability and compensation regime in the light of the interpretation of the Conventions and the application of domestic law in Spain. The case can be seen as one of a number of recent inroads into a shipowner’s ability to rely on limits of liability – a fundamental right that is rooted in maritime law and that supports the functioning and sustainability of marine insurance for pollution liabilities. It should be remembered that the right to limit liability is the essential quid pro quo for shipowners agreeing to accept strict liability for pollution damage up to the CLC limits and is an integral part of the CLC/Fund compensation regime which shares the cost of compensation for oil spills between shipowners and receivers of oil.

In the PRESTIGE case, the Spanish Supreme Court held the P&I Club (London) directly liable both under the 1992 CLC and other laws. The P&I Club was held to incur direct liability above the CLC limit under Spanish domestic law, capped only by the limit of the P&I insurance policy of USD 1billion. The Spanish delegation, at the IOPC Funds April 2016 meeting, had stated that that the Club would be able to rely on the right to limit liability under the CLC 1992 only by means of defence.

So despite having made a cash deposit with the Spanish Court of the limitation amount calculated under the 1992 CLC of some €22.8million in 2003 (formally accepted by the Court as representing the liability limit of both the owner and insurer under Article V of the Convention), the Club could not avail itself of the CLC limit as it had failed to take part in the proceedings. The Spanish Court also took the view that by constituting a fund under CLC 1992, the Club had also waived any right to rely on the ‘pay to be paid’ rule.Strong interventions were made at the Funds meeting both on behalf of P&I insurers and by the International Union of Marine Insurers (IUMI) as to the consequences of this interpretation of the Convention.

The International Group of P&I Clubs raised its concerns at the threat to the compensation regime that this presents. There was no reason for the Club to appear in the proceedings as the distribution of the limitation fund was a matter for the Court itself. Nothing in the Convention suggests that the right to limit is dependent on appearing in the Court proceedings themselves.

IUMI also expressed its concern at the impact of the judgement on business models and assumptions that underpin the writing of long tail pollution liability and the capital requirements now needed to support this class of business given the uncertainty of the CLC limits being upheld by national courts. Some may question whether this class of insurance may now be viable to underwrite profitably.

A number of Member State delegations also expressed their concern that there should be uniform and strict implementation of the international liability regime and at the impact of the PRESTIGE judgement on owners and the insurance industry.

November 2017 update:

A Spanish court on Wednesday 15 Nov. 2017 (fifteen years after the incident) ordered the London Steam-Ship Owners’ Mutual Insurance Association, aka the London Club, which insured the ship, to pay up to 1.6 billion Euros in damages.

A spokesman for London Club said it was aware of the judgment and “remains concerned at the direction that the Spanish court has taken generally.” He pointed to a judgment with the UK’s Court of Appeal in 2015 in which the London Club argued that claims should fall under English law and London arbitration. “There are several complicated and outstanding legal issues that need to be addressed,” he said.

The total cost of the damage has been estimated at over €4.4bn, with 22,000 dead birds found in the immediate aftermath of the incident.

Watch the video documentary below:

For more Maritime History, click HERE