(www.MaritimeCyprus.com) The ICS Maritime Barometer is the first full-scale annual survey of risk and confidence among maritime leaders. More than 130 decision makers, half of them shipowners and around 35% consisting of ship managers, have provided insight into the issues preoccupying them and how they are placed to manage their impact.

It captures data on the following:

- What are the biggest challenges and opportunities facing the maritime sector today?

- How is the risk profile of the maritime sector evolving?

- How confident are companies in mitigating long-term and emerging issues?

The result is a ‘snapshot-in-time’ that highlights industry priorities and perspectives on factors that will be critical to the short-term success and long-term viability of the sector. By comparing the results with those from the pilot study in 2021, this report traces the evolution of both the risks themselves – with some concerns fading and new threats emerging – and the industry’s perceived capability in handling them.

The report is divided into two main sections:

Top risks for maritime leaders – from political instability to industry reputation, how the C-suite views the threats and capabilities around key issues.

Decarbonisation, fuels and emissions – a deep dive on attitudes to the many concerns on climate dominating industry discussion, from fuel choice to funding.

The aim of this report is to present objective insight into perceived industry risk and confidence, which can be used to inform how the industry – and individual stakeholders within it – respond to key issues. As future surveys trace the evolution of risks and confidence, the ICS Maritime Barometer aims to become a valuable tracker of industry preparedness and action, showing the responsiveness of the maritime industry in the face

of challenges to its business.

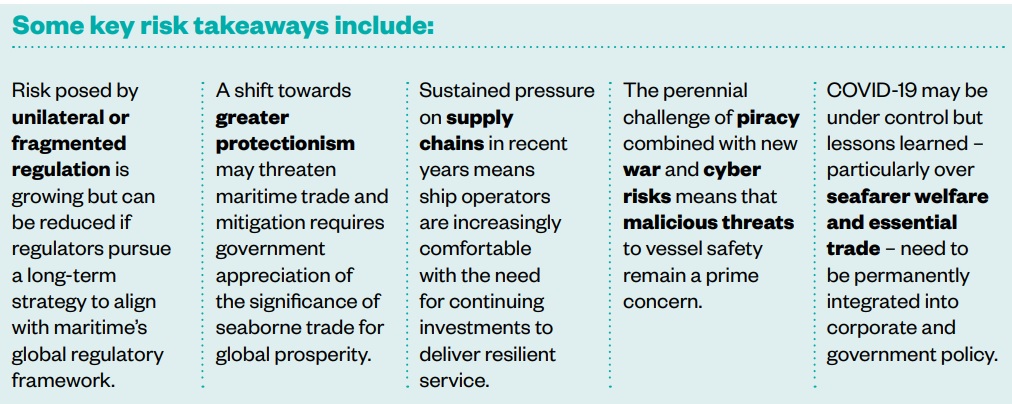

Top risks identified were political instability, financial instability and cyber-attacks – a full switch from 2021 when we undertook a pilot survey, when epidemics, supply chain fragility and trade barriers were the key concerns. As financial and political risk has risen, particularly due to the ongoing conflict in Ukraine, so too have concerns about companies’ capabilities to manage such issues. A key takeaway for this year is that although some risks hold the potential to have a serious impact on operations, maritime leaders have high confidence in the industry’s abilities to manage these situations. This is the case with both

geopolitical and macro-economic events which though disruptive, can be handled well with adequate planning – particularly in situations where there is sufficient information available about the impact of these events.

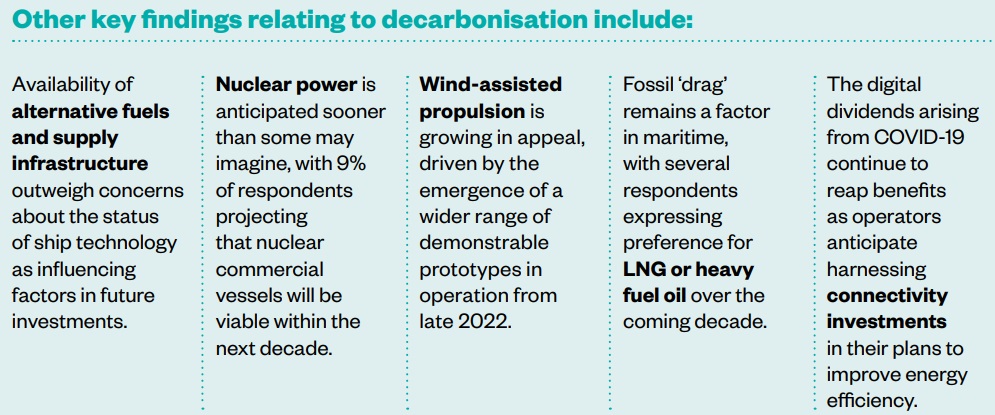

Respondents also shared their views on decarbonisation factors, highlighting a maturing of the industry’s understanding of the complex implications of the energy transition. While the practical consequences of new GHG reduction regulations have continued to be the biggest concern for two years in a row, respondents demonstrated evolving opinions on the fuel landscape.

There is also a growing awareness of environmental commitments and reputation management, which has meant that investor requirements have moved ahead of public funding as a significant concern for respondents.

Meanwhile, continuing concerns about stranded assets and the lack of regulatory and technological clarity, are supplemented by concern over the potential impact of carbon pricing measures.

Emerging considerations include delivering a “Just Transition” to address maritime decarbonisation’s impact on seafarers and ensure they are provided with adequate training for the use of new fuels and technologies. More generally, the availability of competent and high-calibre crew is a growing issue for ship operators, especially with an expanding global fleet operating in a more fractured geopolitical landscape.

For more details, click on below image to download ICS Maritime Barometer Report 2022-2023.

Source: International Chamber of Shipping